Guest bloggers Varnika Goel, Co-founder and Research Director at Twimbit, and Shrestha Patodia, Senior Consulting Analyst at Twimbit discuss their report, “Global State of Open Finance 2025,” developed in collaboration with F5.

The financial world is entering a new phase—one defined not by closed systems or siloed channels, but by openness, interoperability, and embedded intelligence. A global shift is taking place in which consumers and businesses can securely share their financial data across platforms, apps, and services to access better, more personalized experiences.

From instant credit approvals in e-commerce checkouts to holistic money management tools, open finance is making financial access easy for the masses. It is built on an architecture of trust, governed by policy-aware APIs.

Our report, Global State of Open Finance 2025, explores how open finance is unfolding across regions, with the goal of helping businesses make more informed decisions on open finance in the era of AI.

A global movement with local realities

Across the globe, many governments and regulators are pushing toward open finance frameworks, each tailored to local priorities:

- The UK’s Open Banking initiative started a wave of regulated data sharing.

- Brazil has gone further with Pix and a full Open Finance mandate.

- India’s Account Aggregator framework integrates banking, insurance, pensions, and investments under user consent.

This global activity is producing results. Financial institutions are exposing a significant number of APIs, with over 137 billion API-driven financial transactions occurring each year.

Yet, today, more than 1.4 billion people don’t have access to traditional banking services—a signal of how much potential is still untapped. With embedded finance projected to create $7.2 trillion USD in new value, the imperative is to build infrastructure that can scale across markets and protect data.

APIs acting as a foundational layer of open finance have transcended from connectivity to control. Traditional integrations relied on brittle custom connectors; open finance APIs are designed for interoperability, auditability, and resilience.

For example: A lending platform might aggregate income and spending data across five banks to assess risk. Or a fintech savings app could pull in insurance and pension data to offer investment advice.

API security: The enabler of trust and scale

Every API in the open ecosystem must validate the data usage, controls, and permissions in real time. That means adopting zero-trust principles is critical, not just for external third parties but also between internal systems and services.

- API gateways manage traffic and enforce policy.

- Authorization proxies handle fine-grained permissions and identity checks.

- Monitoring systems detect anomalies and support compliance audits.

In regions where regulation is still catching up, these capabilities often outpace compliance requirements. They offer institutions a way to innovate securely and prepare for future interoperability.

AI is now essential to financial services innovation, with the potential to drive real-time risk scoring, more personalized engagement, and better fraud detection, all reliant on secure, high-performance APIs. APIs are evolving from simple connectors into control layers for intelligent agents. Whether it’s a virtual CFO making liquidity decisions or a cross-border payments bot optimizing foreign exchange routes, these agents will act through APIs.

To safely unlock AI’s potential in open finance, APIs must do more than expose functionality. They must embed trust, enforce real-time controls, and make every interaction accountable.

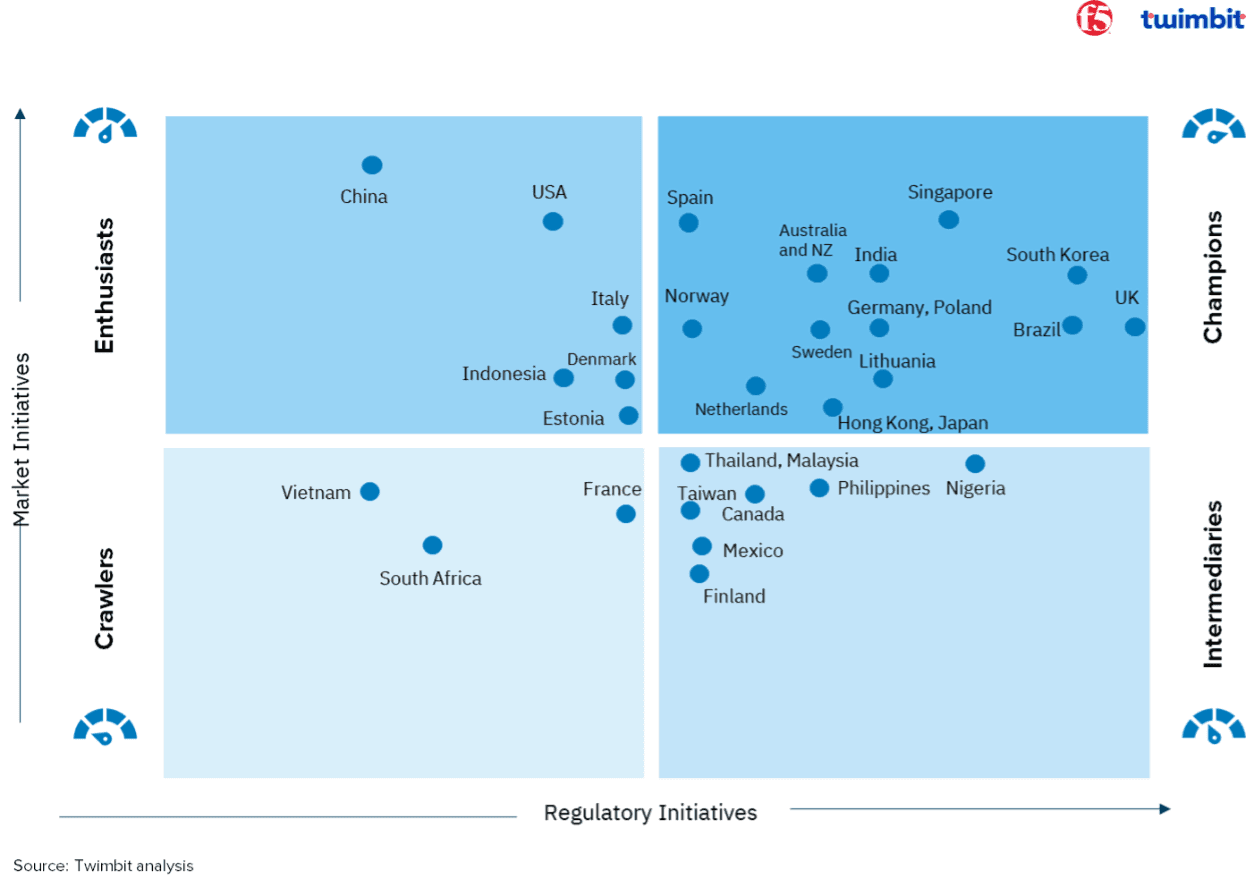

Mapping the momentum: Global Open Finance Maturity Index

Featured in the aforementioned report, Twimbit’s Global Open Finance Maturity Index, developed in collaboration with F5, evaluates 32 markets based on two key pillars: regulatory initiatives and market-driven innovation. Together, these offer a comprehensive view of how financial ecosystems are evolving.

Each country falls into one of four categories:

- Champions like the UK and South Korea show strong leadership across both regulatory and market fronts.

- Enthusiasts, including the U.S. and China, exhibit vibrant fintech innovation but are still evolving their regulatory models.

- Intermediaries, such as Nigeria and Thailand, are steadily progressing across both dimensions.

- Crawlers, like Vietnam and South Africa, are in early stages laying the groundwork for future growth.

Twimbit’s Global Open Finance Maturity Index, developed in collaboration with F5, evaluates how financial ecosystems in 32 countries are evolving in terms of regulatory initiatives and market-driven innovation.

This framework highlights the different starting points and strategies countries are taking to modernize finance—each shaped by unique policy goals, infrastructure readiness, and innovation cultures. As global standards converge, the opportunity lies in accelerating secure interoperability and designing policies that keep pace with innovation. The journey to open finance leadership is not linear—but it is happening everywhere. And every step forward builds toward a more inclusive, API-driven financial future.

To explore how different regions are approaching this transition and what it means for your architecture, compliance, and competitive strategy, explore our report in collaboration with Twimbit: Global State of Open Finance 2025.

Also, be sure to learn more about better securing your open finance ecosystem.

About the Author

Related Blog Posts

Why sub-optimal application delivery architecture costs more than you think

Discover the hidden performance, security, and operational costs of sub‑optimal application delivery—and how modern architectures address them.

Keyfactor + F5: Integrating digital trust in the F5 platform

By integrating digital trust solutions into F5 ADSP, Keyfactor and F5 redefine how organizations protect and deliver digital services at enterprise scale.

Architecting for AI: Secure, scalable, multicloud

Operationalize AI-era multicloud with F5 and Equinix. Explore scalable solutions for secure data flows, uniform policies, and governance across dynamic cloud environments.

Nutanix and F5 expand successful partnership to Kubernetes

Nutanix and F5 have a shared vision of simplifying IT management. The two are joining forces for a Kubernetes service that is backed by F5 NGINX Plus.

AppViewX + F5: Automating and orchestrating app delivery

As an F5 ADSP Select partner, AppViewX works with F5 to deliver a centralized orchestration solution to manage app services across distributed environments.

F5 NGINX Gateway Fabric is a certified solution for Red Hat OpenShift

F5 collaborates with Red Hat to deliver a solution that combines the high-performance app delivery of F5 NGINX with Red Hat OpenShift’s enterprise Kubernetes capabilities.