To say digital transformation is a massive project for any banking or financial services institution would be an understatement. For several years now, leaders across the industry have been carefully implementing projects big and small to address the challenges associated with digital transformation, but many have proven slow to show results, and it’s not getting any easier. That may explain why, according to Gartner, 49% of banking and investment CIOs, and 44% of insurance CIOs plan to increase their investments in automation in 2021.1

In this article, we’ll discuss the top 5 challenges financial institutions are up against as they face digital transformation head on.

Top 5 Digital Transformation Challenges Standing in the Way of Rapid Innovation

1. Poor digital experiences

Poor customer experiences directly leads to customer churn and lost revenue. By not keeping up with their customers’ growing demands for positive digital experiences, banking and financial services organizations risk losing market share and reducing profitability.

This demand for smoother experiences has been accelerated by fintech innovators offering more simplified and quicker digital experiences as well as “wow factor” capabilities like advisor technology with money guidance and more. In fact, according to a recent 2020 McKinsey & Company survey, 40% of US financial decision makers say they have a fintech account.2

Nothing has accelerated the demand for better digital experiences like the COVID-19 pandemic. During the first quarter of 2020, J.D. Power reported that 30% of consumers surveyed were using their mobile banking app more—and 35% were using online banking more—than they were before the pandemic began.3 Mastercard reported that during the same period, 79% of consumers worldwide and 91% in Asia Pacific said they were now using contactless, tap-and-go payments—and the vast majority said they would continue to use contactless transactions after the pandemic is over.4

2. Evolving security threats

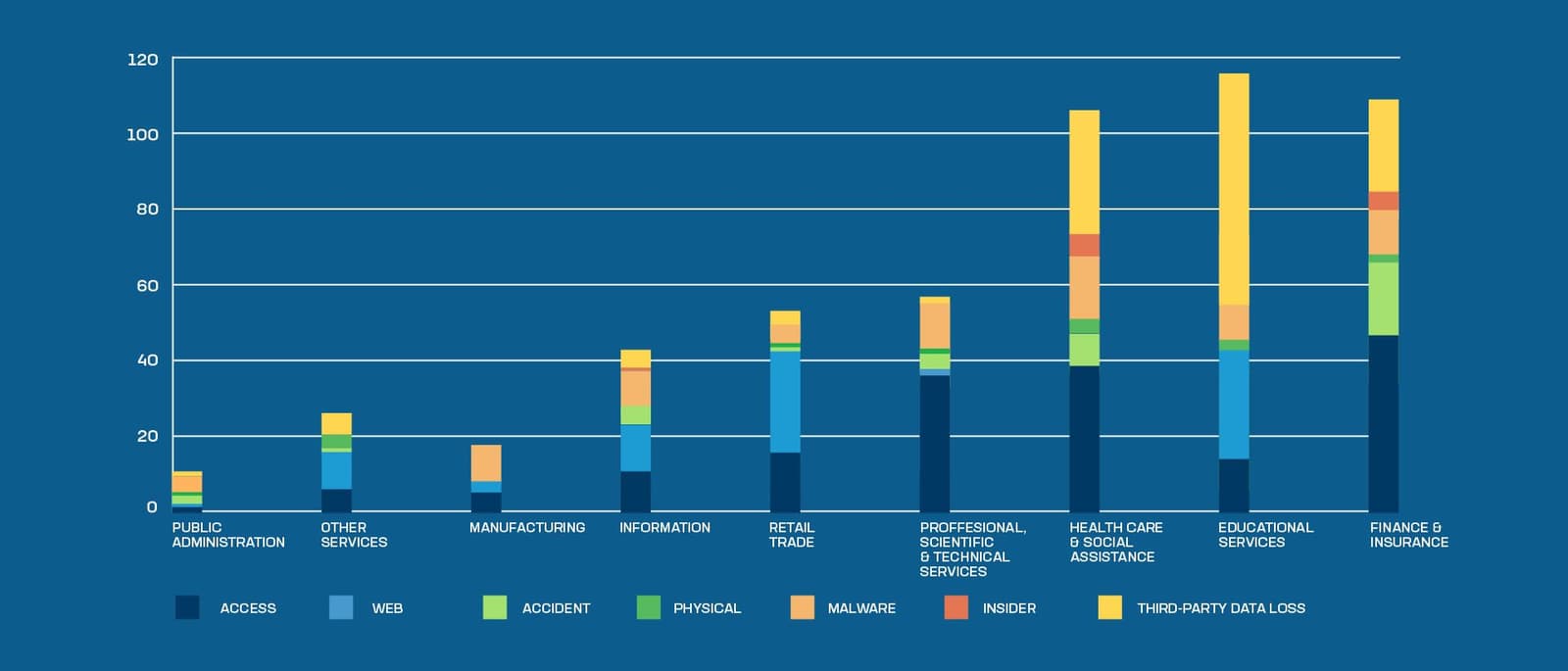

With customers increasingly accessing accounts across multiple channels, devices, and touchpoints, digital access points are prime targets for cyber criminals. The 2021 Application Protection Report from F5 Labs reported finance and insurance organizations saw many of the most common attack techniques (see figure 1 below), including ransomware (Data Encrypted for Impact [T1486]) and a relatively high rate of both phishing and credential stuffing. The finance industry also had the highest rates of insider attacks and physical data breaches.5

Figure 1: Data breaches by sector and cause

It's important to keep in mind that security mitigations like CAPTCHA and SMS-based multi-factor authentication (MFA) introduce friction into the customer experience. When customers are unhappy, you risk decreased revenue, customer dissatisfaction, and increased support costs. Ironically, fraudsters can easily bypass these tools. To keep your account holders happy and prevent fraud at the same time, you need a security strategy that’s more effective and less invasive.

3. Enable rapid application innovation

Inefficiencies associated with complex legacy network architectures significantly increase operational costs. Many organizations have network architectures that are far too complex and vulnerable to human error. Managing and maintaining them requires significant time and resources. By using open APIs to partner with fintechs, aka open banking, some banks have been able to build new and better digital experiences for their customers, but the massive volume of API calls it generates causes latency and security issues and increases costs.

4. Complex app portfolios and development processes

Many banking and financial services firms have app portfolios that are vulnerable to human error, and far too complex. Managing them requires significant operational investment which increases the total cost of ownership, with precious time and resources devoted to maintaining legacy apps that are increasingly inefficient and insecure. App dev teams especially are hampered by legacy architecture, inefficient manual processes, and peer team reviews and procedures that do not integrate well into the app development lifecycle. These disruptions tend to slow innovation, making it extremely difficult to deliver state-of-the-art customer experiences.

5. Regulatory challenges

Bank and financial services regulations have a direct effect on operating costs. Some spend as much as 10% of their operating costs on functions related to regulatory compliance.6 Rising OpEx—compounded by regulatory fines and increasing regulatory requirements—have created a drag on performance and less-than-ideal customer experiences. Fintechs are treated differently regarding regulation, a point often raised by leaders in the industry as an unfair competitive advantage. JPMC’s CEO, Jamie Dimon, for instance, recently called for government regulations aimed at creating a “level playing field” for banks, fintechs, and nonbanks.

The end goal is two-fold:

1. Achieve highly secure, rapid innovation to compete with the latest fintech features and capabilities

2. Successfully implement secure app modernization through automation and self-service for app and API delivery across environments

The right blend of focus on innovation and digital optimization

Organizations need to increase development velocity by integrating app performance, security, and compliance directly into the automation pipeline, helping to minimize developer downtime and optimize performance. They also need to fast track their digital transformation journey with adaptive app solutions that reduce overhead through automation and flexible managed services, which does not lock them into a specific environment.

“To more effectively compete with fintechs, financial institutions must find a solution that doesn’t lock them into a specific environment or require a trade-off between performance and security.”

Improved customer experiences

At the end of the day, your organization’s success depends on happy, engaged customers. To that end, your number one goal (and a major benefit of digital transformation) is exceptionally smooth and innovative mobile and online customer experiences.

You’ll be able to:

Enhanced security and performance

While innovation is a top priority, it should never come at the cost of security or performance. With the right solutions in place, you won’t have to choose.

You’ll be able to:

“The need for business agility is seen in the majority (76%) of financial services that indicated “velocity of new product introduction” as the primary reason for embarking on digital transformation initiatives.”

Accelerated innovation and modernization

By modernizing tools and infrastructure, you’ll not only compete with fintechs, but come out ahead.

You’ll be able to:

Digital transformation can help banking and financial services organizations compete effectively with fintechs, enabling them to accelerate innovation and app modernization, effectively balance performance and security, and offer customers the positive digital experiences they expect.

[1] Gartner: 4 Steps to Automation Success in Financial Services, Finextra

[2] How US customers’ attitudes to fintech are shifting during the pandemic, McKinsey and Company

[3] Digital banking is surging during the pandemic. Will it last?, American Banker

[4] Mastercard study shows consumers moving to contactless payments for everyday purchases as they seek cleaner, touch-free options, Mastercard

[5] 2021 Application Protection Report Supplement: Sectors and Vectors, F5 Labs

[6] How intelligent automation is helping to create the next generation of financial services, techUK

[7] JPMorgan Chase CEO Jamie Dimon: Fintech is an ‘enormous competitive’ threat to banks, CNBC

[8] State of Application Services 2020: Financial Services Edition, F5

REPORT

Find out the key elements involved in embracing a successful DevOps strategy.

INFOGRAPHIC

eBook

Solution Overview